As an effective economic measure to mitigate climate change, carbon pricing instrument has been preferred by more and more governments over the world. So far, 46 countries and 28 provinces had implemented an explicit carbon pricing instrument: a carbon tax or an emission trading scheme (ETS)[1]. This accelerated development has led to a rapid growth in associated revenues: in 2017, carbon pricing instruments generated revenue of $32 billion, up from $22 billion in 2016[2]. This increase has sparked a discussion on the use of carbon revenues, since it can no longer be simply thought of as the incidental co-benefit of a policy mechanism. Therefore, the use of carbon revenue cannot be ignored. As China has not yet begun to impose a carbon tax, this paper will introduce the use of China’s ETS revenue from three stages: the CDM era, ETS pilot and the national carbon market.

CDM Era: CCDMF supports national efforts to address climate change

The Clean Development Mechanism (CDM) cooperation under the Kyoto Protocol has brought additional income and advanced concept to some Chinese enterprises. Without an effective financing mechanism, however, the income cannot be guaranteed to be used for addressing climate change. Hence, China has established the China Clean Development Mechanism Fund (CCDMF, hereinafter referred to as “The CDM Fund”), to manage the income from CDM projects and ensure that all funds are used to directly support projects that tackle climate change in China.

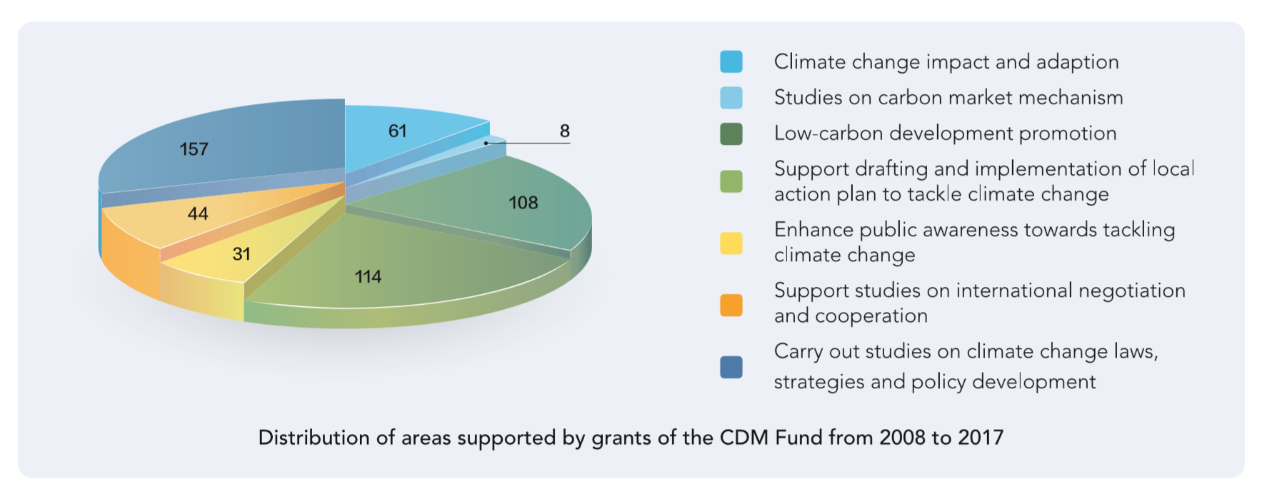

The CDM Fund is mainly utilized in way of grants and investments. Grants are used to support policies and researches on addressing climate change, capacity building and relevant activities to enhance public awareness, including low-carbon development policy research, capacity building and advocacy at the national, local and industry levels. Those engaged in combating climate change in China, and relevant institutions with certain research or training capabilities would receive the grants. As of December 31, 2017, the CDM Fund has arranged RMB 1.125 billion and supported 523 grant projects[3].

Figure 1. Distribution of areas supported by grants of the CDM Fund from 2008 to 2017.

Source: China Clean Development Mechanism Fund 2017 Annual Report

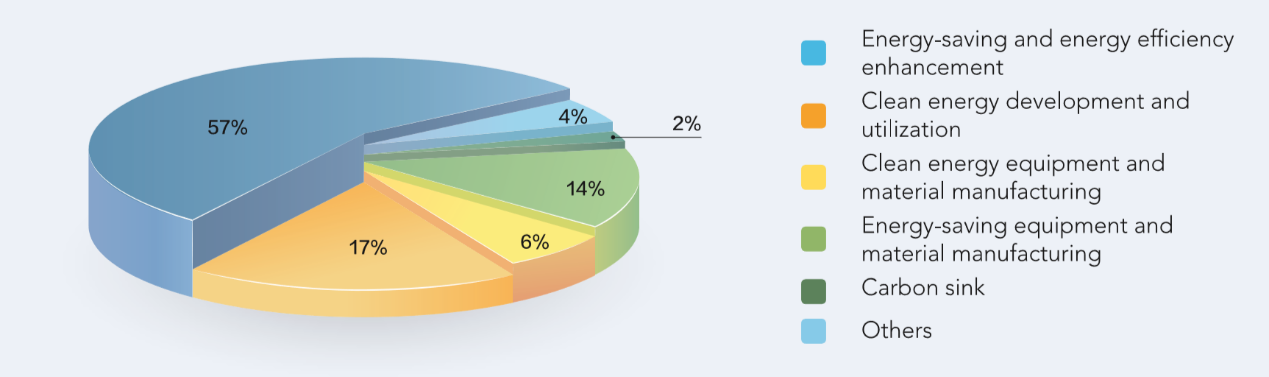

Through investments, the CDM Fund support industrial activities that contribute to climate change mitigation. The CDM Fund adopted concessional loan, equity investment, financing guarantee and other tools to run investment business in the market to support domestic Chinese-invested or Chinese capital-holding enterprises to carry out a variety of activities, such as energy conservation, energy efficiency improvement, development and utilization of clean energy, carbon sink, etc., which are beneficial to control and reduce greenhouse gases. Up to December 31, 2017, the CDM Fund has approved 265 concessional loan projects, covering 26 provinces (autonomous regions and municipalities); and it’s anticipated that the annual carbon emission reduction and carbon reduction potential reach above ten million tons of CO2 equivalent (tCO2e).

Figure 2. Distribution of areas supported by loans of the CDM Fund from 2008 to 2017

Source: China Clean Development Mechanism Fund 2017 Annual Report

ETS Pilots: Auction revenues mainly support emission reduction activities of enterprises

The government can obtain additional revenues by auctioning carbon allowances to enterprises. Auction proceeds can be reinvested in various ways (e.g. subsidizing green projects) or subsidizing low-income families. Since 2013, China’s eight ETS pilots have been running one after another. Allowance allocation of each pilot is mainly based on free allocation, supplemented by auction. In addition to Beijing, Shanghai and Chongqing, other five ETS pilots have announced the use of auction revenue.

The Guangdong Provincial Development and Reform Commission stipulates that 80% of the annual auction revenue must enter the Carbon Fund, which is mainly used to support enterprises’ energy conservation and emission reduction projects and to promote the development of carbon finance and low-carbon industries[4]; Hubei Province will reserve allowance (not exceeding 10% of the total carbon allowance) for market regulation and price discovery, while price discovery adopts an open bidding method. Its bidding benefits are used to support corporates’ activities of emission reduction, carbon market regulation and construction[5]; The auction revenue of Shenzhen ETS is used for carbon market stabilization and regulation, including emission reduction activities, price discovery, capacity building, etc.[6]; and for Tianjin ETS, revenues from auctioning allowance are specifically used to control greenhouse gases[7]. It can be seen that most of the auction revenue obtained by ETS pilot governments are used to support corporate emission reduction activities or capacity building, but they have not yet published the specific allocation of carbon revenues.

Additionally, regulated enterprises can also purchase CCER (Chinese Certified Emission Reduction) in the ETS to complete compliance. The National Development and Reform Commission currently does not charge any fees for CCER project filing and emission reduction filing.

National Carbon Market

China released draft Interim Regulations on the Management of Carbon Emissions Trading (Draft for Comment) on 3 April 2019. Regarding the auction revenue, the draft regulation just mentions that “The revenue generated from the distribution of carbon emission allowances and the cost of purchasing carbon emission allowances will be factored in the budget plan of the central government”[8], not explains the use of these revenues. But as it requires the public comments, some environmental institutions might provide suggestions for an explicit use of carbon revenues.

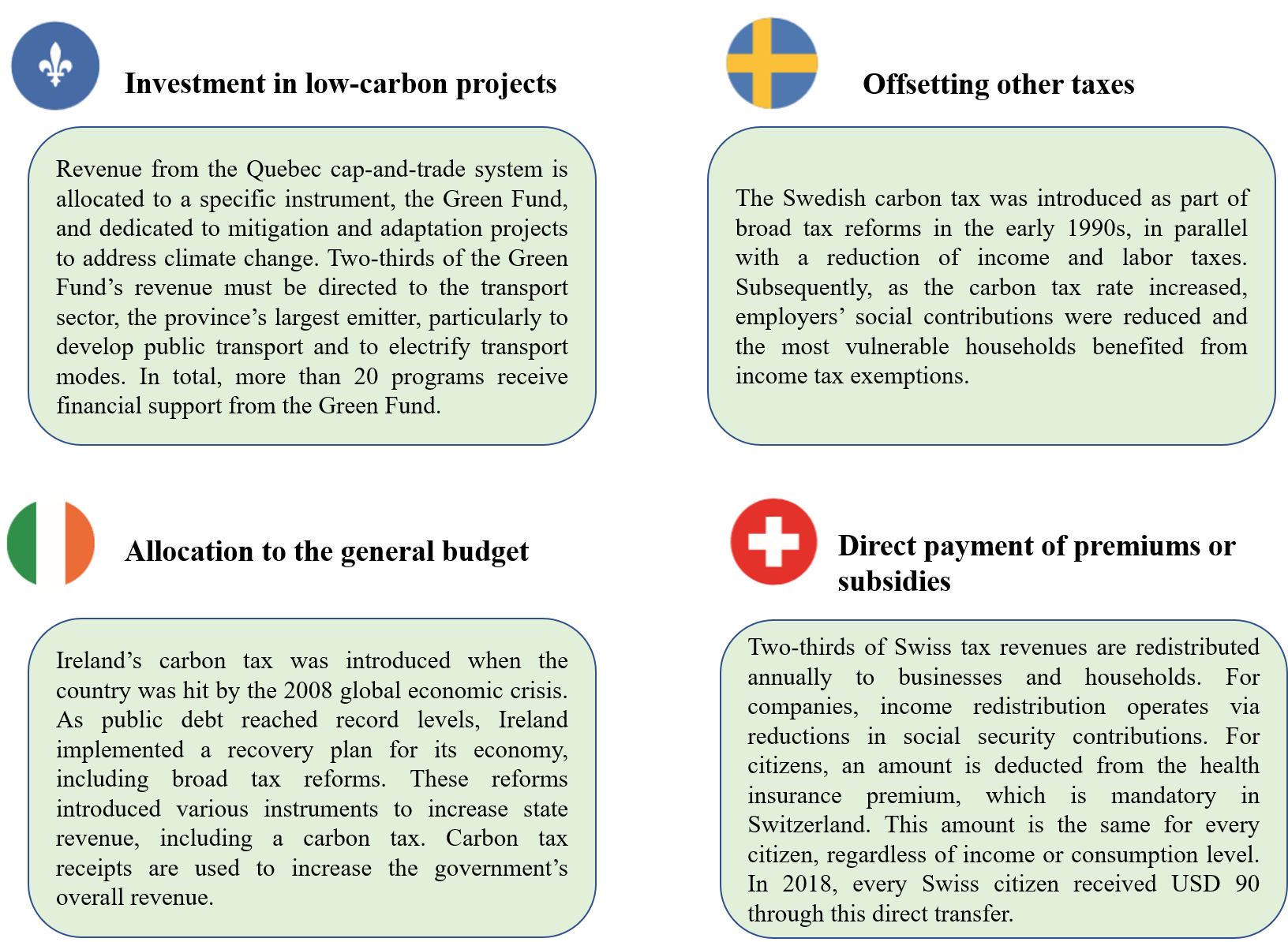

International Experience: Most for investment in low-carbon projects or offsetting other taxes

International experience shows that the use of carbon pricing can be classified into four categories: investment in low-carbon projects (46% of global carbon revenues), allocation to the government budget (44%), offsetting other taxes (6%), direct payment of premiums or subsidies (4%). The following examples are used to introduce the four ways of the use of carbon pricing revenue (Figure 3).

Figure 3. Examples of different ways of carbon pricing revenue usage.

Reference: I4CE "Carbon pricing across the world: how to inefficient spend grown revenues?"

Conclusion

By analyzing the carbon revenue in different phases of China’s carbon market and comparing the use of carbon pricing revenue in four countries, it is clear that China’s current carbon market is less transparent. There is only one sentence in the Regulation and Management of Carbon Trading Market in each ETS pilot, indicating which aspect it will be used for, but not publishing the specific allocation of carbon revenues. The public do not understand how these revenues would be used to invest in low-carbon projects or capacity building. Therefore, we can refer to other national policies to make the policy of the use of carbon pricing revenue more flexible, such as reducing other taxes to benefit enterprises and residents.[9]

References

[1]Carbon Pricing Dashboard, The World Bank, Link: https://carbonpricingdashboard.worldbank.org/map_data

[2]Carbon Pricing across the world: how toefficiently spend growing revenues, I4CE. Link: https://www.i4ce.org/wp-core/wp-content/uploads/2018/10/20181004_PC55_Carbon-Revenues_vENG-1.pdf

[3]China Clean Development Mechanism Fund: 2017Annual Report, CCDMF. Link: http://www.cdmfund.org/eng/jjnbE/20619.jhtml

[4]政府通过拍卖方式分配配额所得收入怎么花,中创碳投。Link:

http://www.tanjiaoyi.com/article-9468-2.html

[5]湖北省碳排放权管理和交易暂行办法,湖北省人民政府网站。Link:http://www.hubei.gov.cn/govfile/ezl/201404/t20140422_1031938.shtml

[6]深圳市人民政府令(第262号)深圳市碳排放权交易管理暂行办法,深圳市人民政府,Link:

http://www.sz.gov.cn/zfgb/2014/gb876/201404/t20140402_2335498.htm

[7]天津市碳排放权交易管理暂行办法,天津市人民政府,Link: http://www.tanpaifang.com/tanjiaoyisuo/2013/1226/27428.html

[8]Interim Regulations on the Management of Carbon Emissions Trading (Draft for Comment), Link: http://fgs.mee.gov.cn/yfxzyfzzfjs/201904/W020190403600998752001.pdf

[9]首图来源:REUTERS/Wolfgang Rattay