It is uncertain whether U.S. President Joe Biden's trip to the Middle East will motivate oil-producing countries, represented by Saudi Arabia, to increase oil production and curb high oil prices. However, the EU's recent statement that it will halt imports of Russian oil by the end of 2022 (with exemptions for Hungary and others) adds another layer of risk to what many observers regard as a global energy crisis already causing concern among policymakers. Against the backdrop of the largest geopolitical crisis since World War II, the EU's decisive shift to the Middle East to meet oil demand in the short term may continue to push up global oil prices. But in the long run, this will provide a stronger impetus for the EU's energy transition.

However, the extent of the energy crisis facing the EU in the short term and whether the influence on global energy security will be beneficial or detrimental, is a topic for debate. The decarbonization process that has emerged in the EU land transportation sector over the past year or two may support the view that the EU, while resisting the energy crisis brought about by the geopolitical crisis, will increase its support for the energy transition in the transport sector in an effort to keep the energy security challenge represented by oil at a reasonable level.

Changes in car ownership in the EU

While the global economic recovery in 2021 has seen a significant increase in car sales in China and the United States, particularly for electric vehicles, the EU has not been as eye-catching. Some say that it will still take time for the EU to return to pre-pandemic car sales levels. But there is also the view that the EU is entering a post-automobile era, which means that people are no longer as dependent on private cars to get around as they once were.

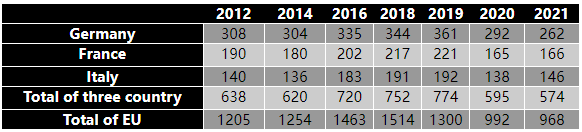

Germany, France, and Italy constitute the EU's three largest economies. Since the United Kingdom's exit from the EU, these three EU countries’ annual new passenger car registrations have stayed constant at 59-60 percent of the EU’s share in 2019-2021. While France and Italy's new car registrations in 2021 hover at the level of 2020, the worst affected year of the pandemic, Germany's new vehicle registrations actually continue to decrease to 2.62 million units in 2021, which is 1 million units away from 2019. And with Germany's economic recovery stronger than that of France and Italy in 2021, Germany's GDP in 2021 already surpass its 2019 total, at €3.57 trillion[1]. If Germany can lead the trend towards lower levels of vehicle ownership per capita in the EU, the decrease in private automobiles will substantially reduce the EU's oil demand. In the near term, this would relieve the pressure on the EU's energy supply by no longer importing Russian oil; in the long run, this would provide substantial support for the EU's climate action.

Table 1: Changes in new car registrations in three European countries, 2012-2021 (in ten thousand units)

Electric vehicle development in the EU remains strong

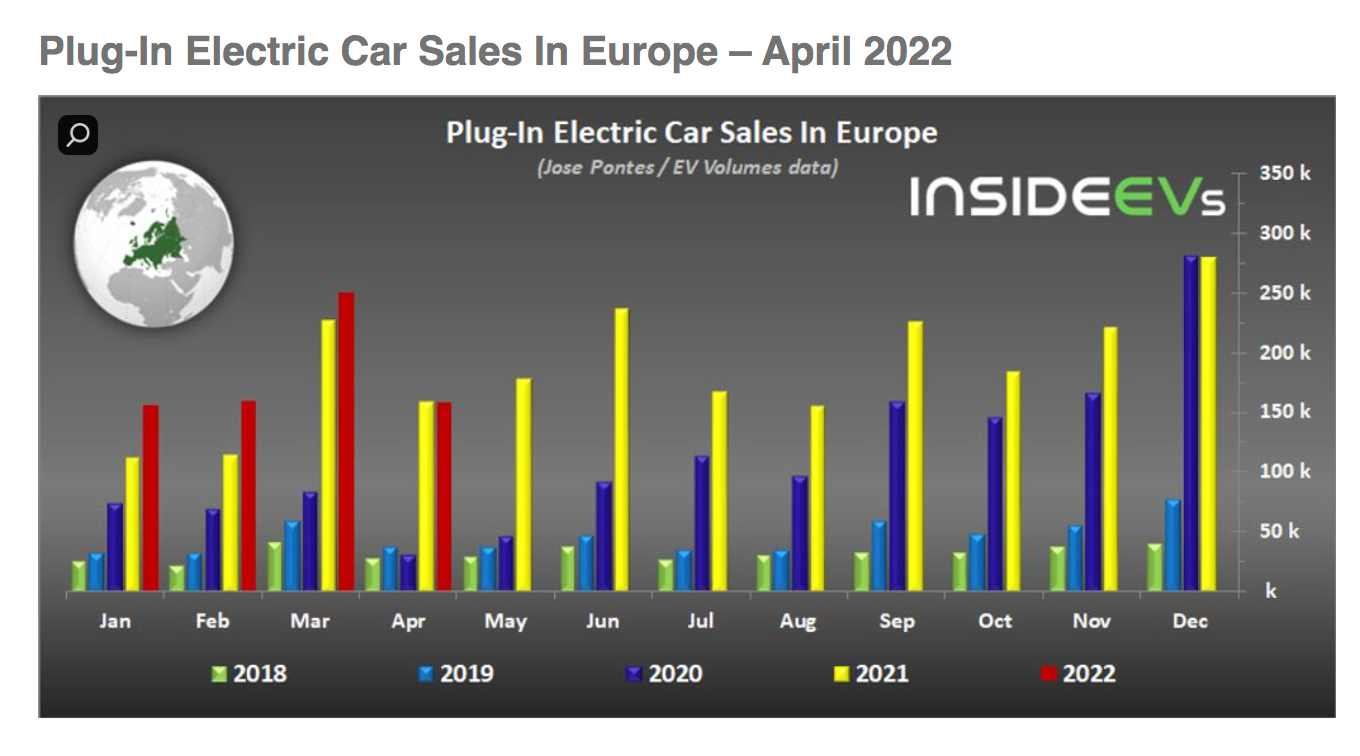

According to the European Electric Vehicle Report[2], in the first quarter of 2022, the total number of newly licensed passenger vehicles in Western Europe, including Germany, France, and Italy, was 2.48 million, with rechargeable electric vehicles and plug-in hybrids accounting for 13 percent and 9 percent, respectively, an increase over the same period last year. According to the European Automobile Manufacturers Association, Volkswagen has sold out of rechargeable electric vehicles in the first four months of 2022 in the European and U.S. markets, and customers after May will have to wait until 2023 to receive their vehicles.

While annual new vehicle registrations are dropping, low-carbon pure electric and plug-in hybrid vehicles are still rapidly taking market share from fuel vehicles, which is obviously good news for limiting oil demand in the road transportation sector. If 25% of new vehicles in the EU are electric by 2022, the EU market for electric vehicles will be well over 5 million units, which could provide a strong relief to the EU's oil supply.

Figure 1: Monthly change in sales of Plug-in electric vehicles in Europe, 2018-2022 (in thousands of units)

Conclusion: The EU that "knows it can't be done"?

Despite the release of one million barrels per day of strategic oil reserves to the market, U.S. oil production will not change the trend of high oil prices. A significant increase in oil production by the Organization of the Petroleum Exporting Countries would alleviate the global energy crisis and assist the European Union in meeting its oil supply challenge in the short term. But whether Biden's visit to Saudi Arabia will bring a turnaround is still unknown. Saudi Arabia has done what it can, the Saudi crown prince just stated at the World Economic Forum in Davos.

In addition to expanding access and continuing to ensure oil supplies in the short term, there is a huge potential brewing on the demand side of the EU. The conflict between Russia and Ukraine is likely to strengthen the resolve of EU residents to opt for electric vehicles and say goodbye to fuel-powered vehicles sooner rather than later. As global oil prices continue to rise, perhaps in a few months we will observe a rapid acceleration of the shift to electric vehicles in the EU, and possibly more incentives will soon be introduced to encourage people to choose electric vehicles. Perhaps it won't be long before we get a clearer understanding of what the EU's determination to abandon Russian oil means, whether it is "to harm others without benefiting oneself " or "to fight an uphill battle"?

Note:

[1] Data from Statista

[2]West European BEV market powers on despite hurricane headwinds. Link: https://www.schmidtmatthias.de/post/west-european-bev-market-powers-on-despite-hurricane-headwinds

Author: Zhao Ang

Translation: Duan Yuxuan

Proofread: Yuan Yating

This article is an original article of the Rock Environment and Energy Institute. Please contact us to obtain the appropriate authorization to reprint. For cooperation and authorization, please send an email to: liying@reei.org.cn

* This is the translation of an article in Chinese. Should there be any inconsistency between Chinese and English version, the Chinese version shall prevail.