A major step in the global carbon neutrality roadmap proposed in the International Energy Agency's (IEA) new Carbon Neutrality 2050 report in May 2021 stated the need for the world to halt investment in all new coal projects by the end of 2021[1]. The report immediately caused significant controversy in the coal industry. Soon, the G7 launched a summit and issued a joint statement to contribute to the globally agreed climate goals and accelerate the pace of coal withdrawal. The world's seven largest developed economies also agreed to stop providing financial support for overseas coal projects by the end of 2021, and on this basis, gradually stop supporting all overseas fossil fuel projects[2]. At the same time, they also called on G20 countries, including China, to join the G7 and make the same commitment before the COP26 at the end of this year.

China has made a climate commitment of reaching carbon neutrality by 2060 in 2020. However, Its still lacking a more specific and clear road map. As the most carbon-emitting energy source, reducing the use of coal is the only way to achieve carbon neutrality. As the world's largest country in coal mining, investment and use, China is under tremendous pressure to put a pause on coal investment. In the first three months of 2020, more coal mine projects in China were approved than in 2018 and 2019 combined. China is also the only G20 country to see a huge increase in coal investment in 2020, accounting for 53% of global coal mining[3].

The arduous process of replacing coal with new energy in China

China still face many challenges on the road to energy transition, such as reducing coal consumption while keeping energy supplies secure to support sustained economic growth. The COVID-19 pandemic in 2020 has hit the global economy hard, and China still has set a target of 6% GDP growth in 2021, showing the country's strong attachment to economic development[4]. Although this year's target is lower than in previous years, it still means that energy demand will continue to increase. If the impacts on climate change, environmental pollution and public health are not taken into account, coal is still relatively low cost comparing to other energy sources. In a country that pursues sustained and rapid economic growth, coal's low costs make it irreplaceable.

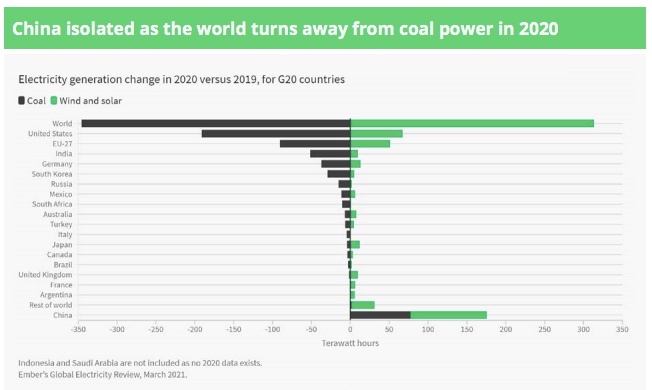

Figure 1: G20 countries' 2020 energy sources versus 2019 index

Except for China, coal energy is decreasing in other countries.

In the past five years, China's investment in new energy technologies has remained a global leader, but the new energy production is not enough to meet the demand for electricity in the country. From 2015 to 2020, China's electricity demand grew by 33%, of which 54% of the demand increase was met by fossil fuel free energy technologies. However, the stability of renewable energy is poor, and in the case of limited experience and technology for secure infrastructure to dispatch power most efficiently, events such as power shortages or power outages will occur.

Just recently, Guangdong, China's largest economic province, has experienced a power shortage. Starting from mid-May 2021, 17 low-level cities in Guangdong Province began to implement limited power consumption strategies, from "six stops and one stop" to "five stops and two stops". There are two main reasons for the power outage; one is that the electricity load in Guangdong Province has increased due to the high temperature this year; and the other is that the main clean energy water power sent from Yunnan to Guangdong by the "West-to-East Power Transmission" channel has insufficient electricity due to a drier season[5]. Expanding investment and construction of power grids is particularly important in the context of reducing coal power consumption and increasing the supply of renewable energy.

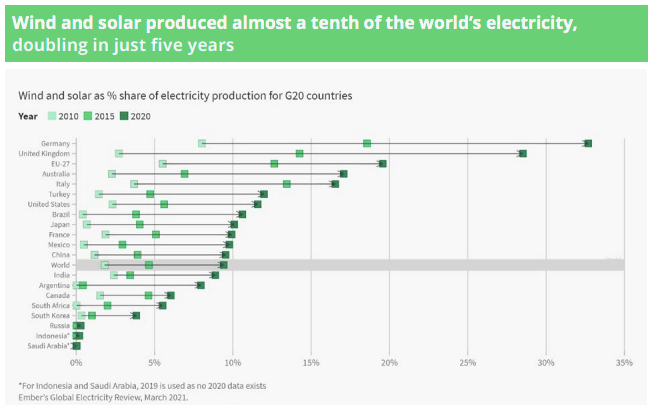

In 2020, an average of 9.4% of global electricity will come from wind and solar power, and China's share of wind and solar power generation is also around the global average. But Germany and the UK account for 33% and 28% of wind and solar power, respectively, far higher than other countries. This is due to the successful integration of a large amount of intermittent energy input into a wide coverage power system in the development of new energy technologies and the construction of power grids[6]. At present, China's power grid infrastructure coverage is low, and it cannot adjust the power distribution according to the dynamics of supply and demand, resulting in many remote areas still relying on fossil fuels to ensure basic power generation. The first step in gradually reducing coal is to ensure the stability of new energy power generation, which can replace fossil energy as the base power supply. The advanced technologies of Germany and the United Kingdom are worth China's attention.

Figure 2: Proportion of wind and solar energy in G20 countries

Source: Ember,2021

The "Belt and Road" carbon reduction

China's coal investment abroad is mainly concentrated in Southeast Asia, India, and Africa under the "Belt and Road" initiative. From 2013 to 2015, Chinese companies invested more than US$100 billion in non-financial sectors in countries along the "Belt and Road", with a focus on energy and transportation investments. China's efforts to reduce its high-carbon emission investment projects while implementing its "Belt and Road" policies has been a huge challenge. Although after 2015, the "Belt and Road" investment projects have become greener, and the proportion of coal projects has lessened, but the number of coal projects is still increasing year after year. Since 2020, China's investment focus in the "Belt and Road" countries shifted to renewable energy for the first time. These include hydroelectric power (35%), coal mines (27%) and solar (23%). However, coal mine investment increased from 15% in 2018 to 27% in 2020[7].

In September 2020, the Asian Infrastructure Investment Bank (AIAIB) announced that it would gradually divest from coal in response to investment trends in global financial institutions. This is the first time a Chinese investment institution has publicly expressed its opposition to fossil fuel investments, and his executive director said "the AIIB will not fund any coal related projects – including roads to coal mines or grid lines serving coal power[8]."

Conclusion: the need of immediate implemention of carbon neutrality strategies in terms of investment and policy incentives

The next 10 years will be crucial for transforming the global energy sector in its emissions reduction, especially in the context of significantly decreasing international coal investment around the world. In terms of coal, industrialized countries around the world has formed a common consensus to accelerate coal reduction, and China is facing increasing pressure to do the same; In terms of oil, 2019 was likely to be the peak year of global oil consumption, while efforts to reduce oil consumption in developed countries are taking shape, with the decarbonization of electricity and the rapid development of electric vehicles in the transportation sector, China may also face pressure to reduce oil consumption in the next 3-5 years; in terms of natural gas, due to its relatively low carbon emission intensity, it could play a more important role in the energy system in the next decade as coal utilization goes through a rapid decline. But in the long run, such as the years 2030-2050, global natural gas consumption will also undergo a process of substantial reduction[9].

As the world's largest coal consumer and the second largest oil consumer, China should also seek more opportunities to launch carbon neutrality implementation plans and strategies as soon as possible, increase investment in various low-carbon technologies, and achieve a complete transformation of energy, transportation, manufacturing and construction in the next 30-40 years[10].

Note:

[1] IEA, 2021. Net Zero by 2050: A Roadmap for the Global Energy Sector. www.iea.org

[2] South China Morning Post, 2021. “In Climate push, G7 agrees to stop funding for coal.” www.scmp.com/news/world/united-states-canada/article/3134443

[3] D. Jones et al., 2021. Ember: Global Electricity Review 2021. www.ember-climate.org

[4] DW news, May 2021. China sets GDP growth target of over 6% in 2021.

[5] 《财新周刊》2021年第21期2021年5月31日 新一轮电荒从何而来?为什么会常态化?

[6] D. Jones et al., 2021. Ember: Global Electricity Review 2021. www.ember-climate.org

[7] 王何礼,2021年1月。2020年中国“一带一路”投资报告。新冠疫情下的一年。中央财经大学绿色金融国际研究院绿色“一带一路”中心。

[8] B. Gao, 2020. China can phase out coal power in line with Paris Agreement, report finds. China Dialogue. www.chinadialogue.net/en/energy/11828

[9] T. Burandt et al. 2019. Decarbonizing China’s energy system – Modeling the transformation of the electricity, transportation, heat and industrial sectors. Applied Energy 255 (2019) 113820.

[10] H. Wang et al. 2020. Early transformation of the Chinese power sector to avoid additional coal lock-in. Environ. Res. Lett. 15(2020) 024007.

Author: Pan Yiren

Translation: Pan Yiren

This article is an original article of the Rock Environment and Energy Institute. Please contact us to obtain the appropriate authorization to reprint. For cooperation and authorization, please send an email to: liying@reei.org.cn

* This article was edited and published by the author in Chinese, because the author accepted an invitation from China Daily.