At the World Economic Forum in Davos in late January 2020, Ursula von der Leyen, the president of the European Commission, announced that the EU would establish the "carbon border adjustment mechanism (CBAM)" from next year, which would levy taxes on products exported by specific countries that have not implemented or effectively implemented carbon pricing. This is not the first time that the European Union has put forward such an idea. Before taking office last year, von der Leyen proposed the plan of "carbon border tax” and launched the “European Green Deal” with carbon border adjustment mechanism as the core [1] at last year's United Nations Climate Conference (COP25).

Before that, EU proposed to use carbon tariff or carbon border tax, levying carbon emission charges on imported products, but the "carbon border adjustment mechanism" is adopted in the above agreements, probably because the tariff or border tax is only applicable to imported products, which is often considered to constitute trade protectionism; on the contrary, the carbon border adjustment mechanism is not only applicable to imported products, but also to domestic products, which is only an extension of domestic practices, thus it is more easily accepted by the World Trade Organization (WTO) [2]. No matter what EU and media call such so-called "carbon tariff" or "carbon border tax", we will follow the current official statement of EU (Green Deal) here: carbon border adjustment mechanism. This article will outline the attitude and view of major global carbon emitters towards the EU's upcoming implementation of CBAM, and briefly discuss the risks and challenges faced by the implementation of this mechanism.

The attitude of major global carbon emitters towards CBAM

The United States: The Trump administration strongly resists

The Trump administration issued a statement on EU’s implementation of the CBAM, saying that if the U.S. finds that this move is for trade protection, the U.S. may take higher tariffs to counteract [3]. From refusing to take the responsibility of advanced emission reduction of developed countries in the Kyoto Protocol to withdrawing from the Paris Agreement, the U.S. government still maintains a negative attitude towards the climate change issue, and believes that the CBAM may be an arbitrary and unreasonable trade discrimination, which may cause a trade war.

China: Hold a negative attitude

China believes that CBAM violates WTO rules, and that it is a unilateralist act taken by the EU against other large carbon emitters, which has a trade protectionist nature [4]. Some scholars consider that this will cause a substantial blow to the export of Chinese products. Although it does not agree with the CBAM, the Chinese government has been taking other measures, such as setting climate targets, establishing a national carbon market, reducing coal consumption, increasing the proportion of renewable energy generation and improving energy efficiency, to promote domestic energy transition and low-carbon development.

Japan and South Korea: still on the sidelines

The governments of Japan and South Korea have yet to comment on the CBAM. Unlike Japan, South Korea launched the national carbon emission trading market (KETS) in 2015, covering eight carbon intensive sectors (e.g. power, steel, transportation, etc.), which is currently in the second period of trading. Therefore, if the EU implements the CBAM in the future, South Korea may also have some measures to avoid taxes charged under the mechanism.

Risks and challenges faced by the implementation of CBAM

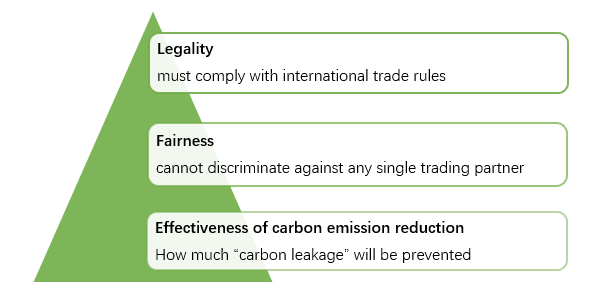

In addition to the objections and doubts of other major carbon emitters, the EU will also face some risks and challenges when implementing the CBAM, such as the legality, fairness and effectiveness of carbon emission reduction.

Figure 1. Risks faced by the implementation of CBAM

Legality

The CBAM must comply with international trade rules. The WTO follows the multilateral trading system and aims to make trade as freely as possible. If the CBAM hinders the free flow of goods, which is contrary to the WTO rules, the EU will face the risk of a large number of trade frictions with its major trading partners.

Fairness

The CBAM cannot discriminate against any single trading partner, nor favor domestic products, and it must also be fair to poor countries with historically far less carbon emissions than developed industrialized countries. Some scholars believe that the CBAM implemented unilaterally by developed countries transfers the environmental legislation costs that they should bear to developing countries. This unreasonable burden transfer violates the common but differentiated responsibility principle established by the Kyoto Protocol [5].

Effectiveness of carbon emission reduction

The CBAM aims to reduce the global "carbon leakage", that is, to reduce the opportunities for enterprises to transfer production and manufacturing to other countries without strict carbon pricing policies. However, at present, there is no research to prove the effectiveness of this measure to prevent "carbon leakage"; in addition, some scholars believe that the risk of "carbon leakage" is not large, and the implementation of CBAM may cause "carbon leakage" to be overcorrected, forming a green barrier to restrict trade [6]. If the EU levies an import commodity tax based on the average price of EU ETS [7], how much effective carbon emission reduction can be brought by the carbon price under EU ETS also requires further research to prove.

Conclusion:

As the ambitions of climate commitments in different countries still differ, the European Commission proposes to implement a carbon border adjustment mechanism in specific sectors to reduce the risk of carbon leakage. Although this measure may play a leverage role in promoting other countries to take corresponding emission reduction measures, whether the purpose of the CBAM is really for global carbon emission reduction, rather than for trade protectionism remains to be verified. In addition, there are many difficulties in the implementation of CBAM, for example, it is hard to calculate the carbon content of imported products, because some product parts are manufactured by many countries; in addition, how to set effective carbon price is also a thorny problem.

Although there are many doubts about the purpose of the EU's proposal for carbon border adjustment mechanism, as global carbon emissions continue to increase and carbon pricing mechanisms have been widely established in various countries, the voice against this measure may gradually weaken. If countries want to avoid the cost imposed by the CBAM, they need to reduce their own carbon emissions faster through other effective carbon reduction measures.

Reference:

[1]The European Green Deal, European Commission, 2019. Link: https://ec.europa.eu/info/sites/info/files/european-green-deal-communication_en.pdf

[2]多边贸易体制下的碳税问题. 陈红彦. 社会科学文献出版社,2016:73

[3]US and EU Argue onCarbon Tax,FinancialTimes. Link: https://www.ft.com/content/f7ee830c-3ee6-11ea-a01a-bae547046735

[4]中国反对欧洲碳边境税,而非反对气候变化措施,徐赛兰,中美聚焦。链接:http://cn.chinausfocus.com/energy-environment/20200108/41706.html

[5]龙英锋,全球气候变化碳税边境调整问题研究.立信会计出版社,2016

[6]闵云,试析边境碳调节的合法性、有效性与公平性(2016)。链接:http://cdmd.cnki.com.cn/Article/CDMD-10284-1016142067.htm

[7]EU’s carbon border tax plan is risky but needed,Financial Times. Link: https://www.ft.com/content/28bbb54c-41b5-11ea-a047-eae9bd51ceba

Author: Yuan Yating

Proofreading: Lin Jiaqiao

This article is an original article from REEI. Please contact the author for reprinting and indicate the source.

For article cooperation and authorization, please send an email to: liying@reei.org.cn