In early 2022, the European Union has released a draft legislation on the classification of sustainable investment, which has caused great controversy. The European Commission proposed to label certain natural gas and nuclear projects as green in its “Taxonomy”, causing Austria threatening to sue the European Commission; and the German Economy Minister taking a lead in the opposition, saying that the proposed classification was “greenwashing” specific fuels [1]; However, The plan still has the backing of France, and central and eastern European countries, which stress the role of nuclear and natural gas in meeting the EU's 2050 climate neutrality goals.

On the surface, the debate is about the scope and role of green energy, while in fact, there is no consensus within the EU on how to apply the so-called “bridging fuels” in energy transition. Specifically, there are disagreements between member countries and the EU on the role of natural gas and nuclear energy development. The European Commission is still collecting feedback, with the deadline on January 21st. It is expected to pass the first part of classification regulation of the “Taxonomy” by the end of this month [2]. This article will sort out the background and driving factors of the sustainable finance taxonomy, and discuss the climate investment logic behind the EU regulation in the context of global response to climate change.

Why is the EU pushing to legislate?

Based on previous research, the proportion of current economic activities in the EU, such as company operations and investment portfolios, conforming to climate classification is low (between 1% and 5%) [3]. The implementation of the EU's Green New Deal requires a green shift in investment to finance climate neutrality by 2050. Achieving the EU's 2030 climate and energy goals requires an estimated additional investment of 180 billion euros per year [4]. For the 2050 climate goal, the EU needs to invest 260 billion euros per year in the coming decades [5].

Afterall, the EU needs to invest heavily to achieve its medium and long term climate goals, but public investment is insufficient and private sector investment is desperately needed to bridge the gap between environmental goals and the funding needed. The “Taxonomy” seeks to guide more responsible and environmentally friendly investment by the private sector by legislating on which investments meet the EU's sustainability requirements. “Green” investments must meet detailed criteria listed in the “Taxonomy” (such as emission limits or energy efficiency),while attracting more private capital to environmentally friendly projects, it also prevents investment institutions and large corporations from exaggerating their environmental performance.

Six environmental objectives define “Green” economic activities

The EU regulation on the Sustainable Finance Taxonomy aims to target private sector investment on projects that are more in line with creating a healthy planet by setting mandatory taxonomy criteria, and the principle of sustainable development is used to measure whether investment is beneficial to the “health of the planet” [6]. After the Paris Agreement, there has been an increased demand for private sector investment. Based on previous efforts in green bond standards, the EU tried to establish a more comprehensive taxonomy standard, which attempted to cover most investment project activities after several years of experience.

The EU Taxonomy is mainly applied to financial market participants and large companies in the EU, aiming to promote a set of compliance principles with common standards, although most of these institutions have their own teams and tools to measure "green" investments. With the EU Taxonomy in place, institutional investors such as investment funds and banks can use these criterion to screen whether an investment can be labelled sustainable, instead of their own diverse and subjective criteria, to prevent investors' greenwashing practices and boost confidence in sustainable assets.

Figure 1: Six environmental objectives of the Sustainable Finance Taxonomy

Source: Sustainable finance factsheet. European Commission Website.

In June 2019, the Technical Expert Group on Sustainable Finance published the first classification system – or taxonomy – for environmentally-sustainable economic activities. To qualify as green, an investment would need to contribute to at least one of these six objectives. The taxonomy regulation, namely “Information about the Regulation (EU) 2020/852 (Taxonomy) on the Establishment of Sustainable Investment Framework”, was applied in July 2020, according to information on the European Commission's website. The EU legislation process is usually long, but it only took a year to pass this regulation, which is comparatively fast. For details, please refer to our previous article on the EU legislation process [8]. The European Commission reserves important details to the delegated acts of addressing technical issues that require long-term discussion through secondary legislation [9], which will avoid the monitor of the stricter primary legislation process by the European Parliament.

The European Commission will set technical standards for each target. The technical standards for climate change mitigation and adaptation targets should have been ready by the end of 2020 [10], but due to the long and uncertain legislative process, only the first part of the investment taxonomy rules on climate change was adopted at the end of 2021. Originally, it was expected to start classifying activities in climate change-related investments that could be defined as green in 2022, in industries including transport and construction in addition to energy. However, the main point of contention at the moment is the definition of sustainable energy in this part of the rules. The first part of the taxonomy, which was due to take effect on January 1, 2022, has been questioned by some member countries over whether natural gas and nuclear power can be considered green energy sources.

What is the key debate about climate change of the Taxonomy?

Under the guidance of the six environmental objectives mentioned above, only by meeting the Technical Screening Criteria (TSC) listed in the taxonomy regulations can economic activities be considered “environmentally sustainable development” [11]. TSC would also determine the conditions under which an economic activity causes any harm to other environmental objectives while qualifying as positive contribution to a certain objective.

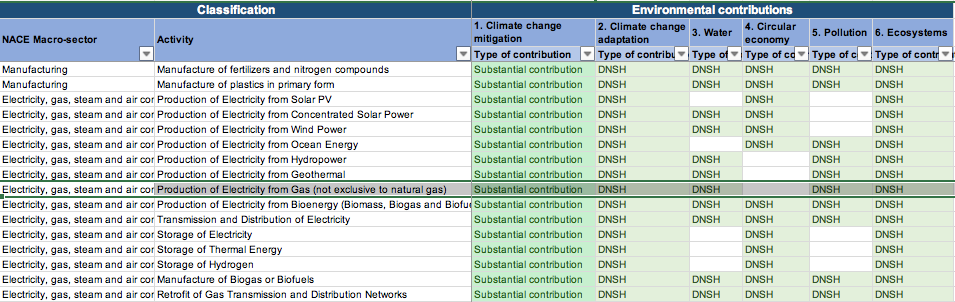

The TSC draft covers as many as 13 sectors, including agriculture and forestry, manufacturing, energy, transportation, construction and so on. The European Commission has also developed an Excel-based Taxonomy Tool (Figure 2), in which natural gas is one of the focal points of this controversy, where the current taxonomy classifies it as a significant contribution to climate change mitigation, and believes it Does No Significant Harm (DNSH) to the other four goals.

Figure 2: Display of electricity-related pages in the Taxonomy Tool

Note: DNSH means "Do No Significant Harm"

Source: Technical expert group on sustainable finance (TEG) - Taxonomy tools. European Commission Website. Link: https://ec.europa.eu/info/files/sustainable-finance-teg-taxonomy-tools_en

Conclusion

The debate within the EU about whether gas and nuclear are “green” has brought sustainable investment to our attention. The EU's electricity grid is integrated, and what makes it interesting is that, Germany and Austria, which are fiercely opposed to the proposal, use French nuclear power, that is stable and cheap, when their own renewables are running low. A consensus is expected to emerge within the EU over the issue, where the disagreement is not to eliminate these sources but to label them as "green" in a sustainable investment taxonomy. Globally, the EU's ambition is not just to steer its own economic activity to meet both sustainability principles and long-term climate goals, the taxonomy is also intended to push the EU's sustainable finance taxonomy criteria to beyond the EU, or to set green terms for funds or financial products entering the EU. However, will it direct investments to worthwhile projects?

Analysis also points out that the taxonomy would not provide incentives for cash-strapped green assets, such as low carbon steel or EV charging stations. Instead, investors may continue to chase safe, liquid assets, such as wind or solar plants, driving up their prices [12]. Therefore, standards alone cannot drive investment in technologies or projects that are in urgent need of capital. While the realization of climate goals in various countries requires private investment, the author believes that taxonomy lays a foundation to setting a benchmark threshold, to improve the quality of investments, and further support policies needed to attract or guide investors in a sustainable direction.

Note:

[1] Fury as EU moves ahead with plans to label gas and nuclear as ‘green’. The Guardian, 2022.01.03. Link: https://www.theguardian.com/world/2022/jan/03/fury-eu-moves-ahead-plans-label-gas-nuclear-green

[2] Investors react to Commission’s Taxonomy move on nuclear, gas By Susanna Rust, et al. 15 January 2022. Link: https://www.ipe.com/investors-react-to-commissions-taxonomy-move-on-nuclear-gas/10057361.article

[3] FAQ: What is the EU Taxonomy and how will it work in practice? European Comission. Link: https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/sustainable-finance-taxonomy-faq_en.pdf

[4] Sustainable finance – EU taxonomy A framework to facilitate sustainable investment. European Parliamentary Research Service. 2020 July. Link: https://www.europarl.europa.eu/RegData/etudes/BRIE/2019/635597/EPRS_BRI(2019)635597_EN.pdf

[5] EU defines green investments to boost sustainable finance. European Parliament, Economy,11-06-2020. Link: https://www.europarl.europa.eu/news/en/headlines/economy/20200604STO80509/eu-defines-green-investments-to-boost-sustainable-finance

[6] Sustainable finance factsheet. European Commission Website. Link: https://ec.europa.eu/info/sites/default/files/business_economy_euro/accounting_and_taxes/documents/190618-sustainable-finance-factsheet_en.pdf

[7] Law details Information about the Regulation (EU) 2020/852 (Taxonomy) on the establishment of a framework to facilitate sustainable investment including date of entry into forcehttps://ec.europa.eu/info/law/sustainable-finance-taxonomy-regulation-eu-2020-852/law-details_en

[8] 欧盟碳边境调整机制真的要到来了吗?REEI ,袁雅婷,2021/03/22. 链接:http://www.reei.org.cn/blog/830

[9] A Short Guide to the EU’s Taxonomy Regulation. David Doyle, S&P GLOBAL 12 May, 2021. Link: https://www.spglobal.com/esg/insights/aligning-portfolios-with-the-paris-agreement

[10] EU defines green investments to boost sustainable finance. European Parliament. 11-06-2020. Link: https://www.europarl.europa.eu/news/en/headlines/economy/20200604STO80

[11]Taxonomy technicalscreening criteria (TSC). Link:https://www.emissions-euets.com/carbon-market-glossary/1923-taxonomy/2209-taxonomy-technical-screening-criteria-tsc

[12]The EU’s green-investing “taxonomy” could goglobal. Fintedex.2022.01.06 Link: https://fintedex.com/the-eus-green-investing-taxonomy-could-go-global/

Author:Lin Jiaqiao

Translation: Chen Shikai

Proofread: Pan Yiren

This article is an original article of the Rock Environment and Energy Institute. Please contact us to obtain the appropriate authorization to reprint. For cooperation and authorization, please send an email to: liying@reei.org.cn

* This is the translation of an article in Chinese. Should there be any inconsistency between Chinese and English version, the Chinese version shall prevail.