The two-week long COP26 concluded on Saturday with 200 countries signing the "Glasgow Climate Pact", which for the first time an agreement explicitly set targets to reduce coal use. In addition, delegates from many countries agreed to stop deforestation and reduce methane emissions by 2030. As part of the Pact, delegates hammered out details of Article 6 on the final day of the conference. Xie Zhenhua, China's Special Envoy for climate change, said at the conference that "it is expected that the carbon market rules of Article 6 of the Paris Agreement will be agreed upon at this conference" [1]. Our previous article "What Main Issues in Article 6 Are Still Not Agreed upon?" introduced the specific content of implementation rules of Article 6 and main contentious points, while this article will sort out and comment on the key negotiation results of Article 6.

Avoid “Double Counting”?

Under Article 6, countries can use carbon market mechanisms, including carbon quotas and carbon offsetting credits, to help them meet their NDCs, to fulfill their 2030 emission reduction obligations under the "Paris Agreement". The final commitment stated that countries implementing carbon reduction projects may decide whether to sell credits or to account them for their NDCs, and they must inform the UN Supervisory Board accordingly. Authorized by the UN, if they choose to sell credits, they must include "Corresponding Adjustment" on emission reduction in their own NDCs, meaning that carbon emission reduction between the buyer and the seller can only be counted once to avoid double-counting.

Share of Proceeds from Bilateral Deals?

Developing countries and the Alliance of Small Island States have proposed that Share of Proceeds obtained from bilateral deals under Article 6.2 should be set aside to support vulnerable countries' climate change adaptation, similar to that of article 6.4. However, the EU and the United States believed the "Share of Proceeds" would restrict trade, as it is equivalent to "Transaction Tax" when buying carbon credits from other countries. Eventually, all parties agreed to levy only 5 percent of the revenue for the Adaptation Foundation under Article 6.4, and countries engaging in bilateral or multilateral transactions were encouraged to donate to the Adaptation Foundation voluntarily [2].

Can countries achieve their NDCs by Using Carbon Offsetting Credits from the “Kyoto Protocol” period?

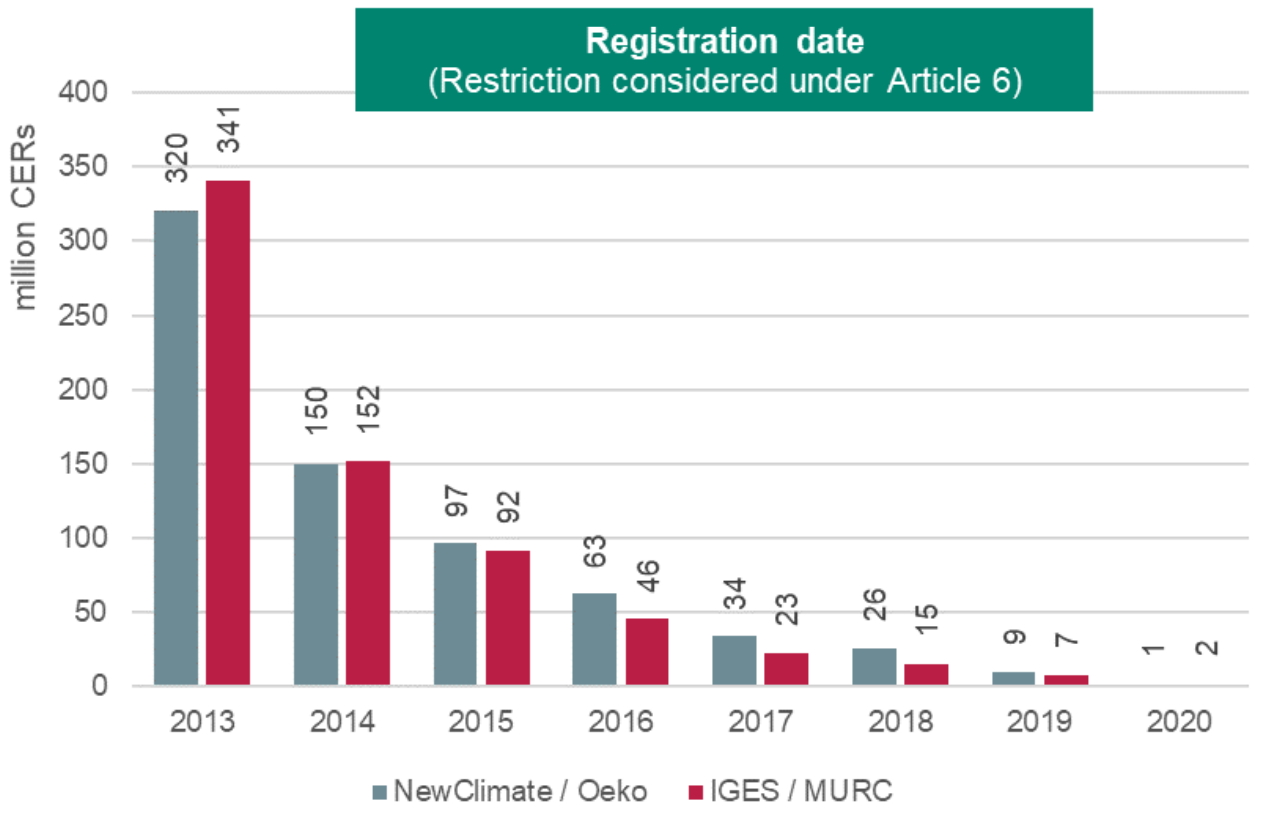

What's been controversial was whether carbon offsetting credits from the "Kyoto Protocol" period, known as Certified Emission Reductions (CERs) under Clean Development Mechanism, can be carried forward to the international carbon offsetting market under Article 6.4, and be used to realize their NDCs. Countries with a large number of CERs, led by Brazil, and countries opposing CERs carry-over, led by the European Union, made a compromise on this issue, consenting to set a time limit to avoid all CERs being double counted. The final statement regulated that only CERs registered after 1 January 2013 can be used to be included in their first NDCs. [3]

Although the period for which CERs can be carried forward is limited, more than 300 million CERs were registered after January 1, 2013 (Figure 1) [4]. Currently, the additionality and low-price of CERs are still controversial, at the same time, there are also many grey carbon offsetting programs (such as waste incineration programs) [5] in CDM projects. If they are accounted in NDCs, It may lead to an increase of global greenhouse gases emission, In my opinion, I believe that in order to ensure environmental integrity, countries should avoid using CERS from the "Kyoto Protocol" period but focus on new, additional carbon offsetting credits.

Figure 1. The Number of CERS under Different Registration Deadlines

Conclusion

Although there were unsatisfactory aspects in Article 6's detailed implementation rules, such as accepting cheap and "overdue" credits. However, the market mechanism of Article 6, carbon offsetting market of Article 6.4 especially, would provide opportunities for the private sector to mitigate climate change, enable companies to to fulfill part of their net zero commitments by buying carbon offsetting credits. Furthermore, it would also indirectly mobilize more private capital to developing countries, to help them adapt to and mitigate climate change. Eventually, these rules will be further revised and countries will develop national strategies and policy frameworks based on Article 6 to achieve their own climate goals.

Note:

[1] China's top climate negotiator sees carbon market deal at COP26, Reuters, Link: https://www.reuters.com/business/environment/chinas-top-climate-negotiator-sees-carbon-market-deal-cop26-2021-11-02/

[2] Draft CMA decision on guidance on cooperative approaches referred to in Article 6, paragraph 2, of the Paris Agreement, UNFCCC, Link: https://unfccc.int/sites/default/files/resource/Art._6.2%20_draft_decision.pdf

[3] Draft CMA decision on the rules, modalities and procedures for the mechanism established by Article 6, paragraph 4, of the Paris Agreement, UNFCCC, Link: https://unfccc.int/sites/default/files/resource/Art.6.4%20draft_decision.v4.pdf

[4] CDM supply potential for emission reductions up to the end of 2020, IGES等四家机构,Link: https://www.iges.or.jp/en/publication_documents/pub/discussionpaper/en/11072/CDM+supply+potential+for+emission+reductions+up+to+the+end+of+2020.pdf

[5] 碳市场工作手册:碳抵消的可持续性, 磐之石, Link: http://www.reei.org.cn/publication/761

Author:Yuan Yating

Translation: Chen Shikai

Proofread: Pan Yiren & Lin Jiaqiao

This article is an original article of the Rock Environment and Energy Institute. Please contact us to obtain the appropriate authorization to reprint. For cooperation and authorization, please send an email to: liying@reei.org.cn

* This is the translation of an article in Chinese. Should there be any inconsistency between Chinese and English version, the Chinese version shall prevail.